Activated Carbon Market to Reach USD 5.4 Billion by 2032, Growing at 4.2% CAGR

Activated Carbon Market size is expected to be worth around USD 5.4 billion by 2032 from USD 3.6 billion in 2022, growing at a CAGR of 4.2%

NEW YORK, NY, UNITED STATES, February 5, 2025 /EINPresswire.com/ -- Overview

The global activated carbon market, valued at USD 3.6 billion in 2022, is poised for substantial growth, projected to reach USD 5.4 billion by 2032. This expansion is driven by a compound annual growth rate (CAGR) of 4.2% from 2023 to 2032. Activated carbon's primary applications are in air and water purification due to its high adsorption capabilities arising from its porous structure, making it crucial in sectors like wastewater treatment, air purification, and other industrial uses.

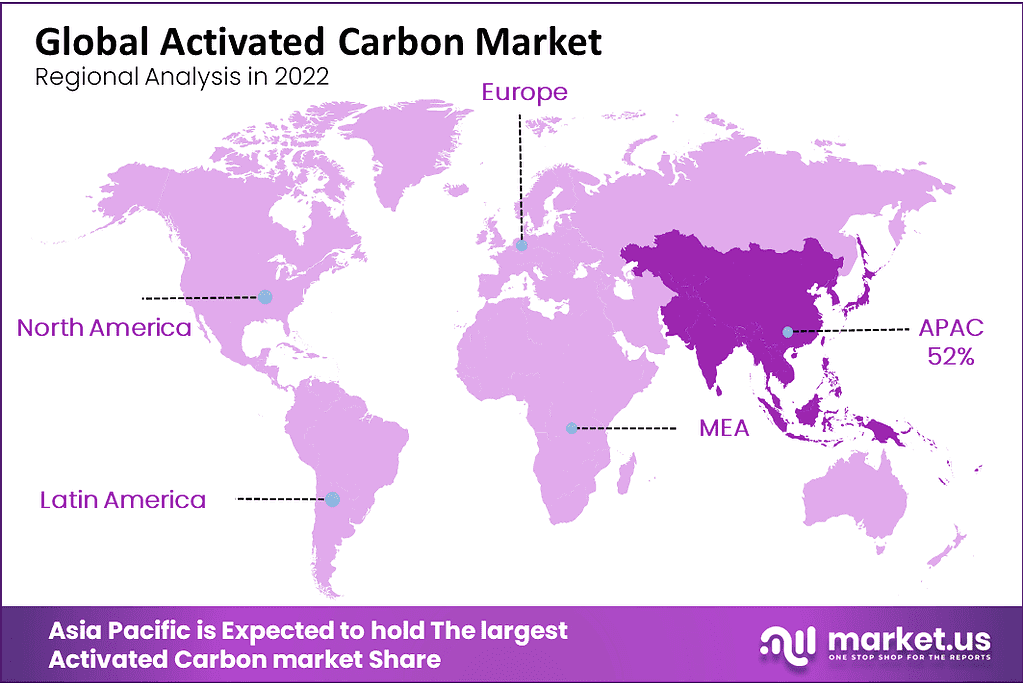

Key raw materials include carbonaceous materials such as coal, wood, and coconut shells. Increasing environmental concerns and stringent regulations fuel demand for effective purification systems. The Asia-Pacific region, with a substantial market share, dominates due to factors like high coconut shell availability and industrial applications in water purification and gold mining. Despite the promising growth potential, challenges persist, including high production costs and raw material scarcity, which could restrain market expansion.

Key Takeaways

• Market Developments: The global activated carbon market experienced steady expansion since 2022, reaching USD 3.6 billion at its valuation. Projections indicate an exponential leap, projecting that this market will reach an anticipated value of approximately USD 5.4 billion by 2032 – representing a compound annual growth rate of 4.2% from 2023-2032.

• Type Analysis: Based on product, the market can be divided into activated granules and powdered activated carbon products as well as others. Powdered activated carbon is estimated to reach US$2192 million by 2022 with compound annual compounded growth expected at 4.4% over its forecast period.

• Form Analysis: Market growth will likely be stimulated by rising demands for water treatment techniques due to regulatory requirements and industry standards that stipulate this practice.

• End-Use Analysis: Water treatment was once one of the dominant final-use sectors. Today, however, new technologies for water purification continue to gain worldwide appeal and activated carbon companies continue exploring ways to develop technology that improves efficiency for treating wastewater.

• Regional Dominance: At 52% activated carbon market share, the Asia Pacific region held onto its dominance until 2022. Asia Pacific markets offer perfect conditions to purchase coconut shell AC and coconut shells while activated carbon is utilized in water purification as well as mining gold.

👉 Request a free sample PDF report for valuable insights: https://market.us/report/activated-carbon-market/request-sample/

Experts Review

Government incentives and technological innovations are pivotal in the activated carbon market's evolution. Many governments emphasize environmental conservation, propelling incentives for technologies that advance air and water purification. Technological innovations, such as enhanced adsorption capabilities and lifecycle improvements, mitigate investment risks and open new avenues. Consumer awareness and regulatory environments also contribute significantly. Technological advancements raise consumer expectations for cleaner, safer environments, boosting market demand.

However, the regulatory landscape poses challenges; strict environmental regulations require constant product innovation to comply, raising operational costs. Investment risks include fluctuating raw material prices and environmental compliance costs but also opportunities as awareness of pollution grows and technological innovations continue to simplify application and increase efficacy. Overall, the balance between capitalizing on incentives and navigating regulatory frameworks will determine market leaders' success.

Report Segmentation

The activated carbon market report segments the market by type, form, and end-use applications. By type, it divides into granular activated carbon, powdered activated carbon, and others, with powdered activated carbon holding a significant share due to its superior adsorption properties. In form segmentation, gas-phase and liquid-phase activated carbon are distinguished, with the liquid phase playing a critical role in water treatment due to environmental norms. End-use applications cover air purification, food and beverage processing, water treatment, pharmaceutical and medical uses, and others.

Water treatment emerges as the dominant sector, driven by global wastewater management demands and technological innovations in purification methods. Geographic segmentation highlights Asia-Pacific's dominance, influenced by high availability of raw materials and industrial demand, followed by North America and Europe, where technological application and regulatory compliance fuel market activity.

Key Market Segments

By Type

• Granular Activated Carbon

• Powdered Activated Carbon

• Other Types

By Form

• Gas Phase

• Liquid Phase

By End-Use

• Air Purification

• Food & Beverage Processing

• Water Treatment

• Pharmaceutical & Medical

• Other End-Uses

👉 Buy Now to access the full report: https://market.us/purchase-report/?report_id=16904

Drivers, Restraints, Challenges, and Opportunities

Drivers of market growth include stringent environmental regulations and rising demand for clean air and water, enhancing adoption across sectors. Conversely, high production costs and raw material dependency challenge sustainability and pricing. Raw material availability, particularly coconut shells, is a critical restraint, exacerbated by environmental disruptions affecting supply. Challenges also include compliance with evolving environmental standards, which necessitate frequent technological advancements.

Despite these, opportunities abound—a significant rise in environmental consciousness and regulatory pressures fosters technological innovations in mercury removal and air purification. Expanding applications, such as in the medical sector for control of drug emissions, present further potentials for market expansion. Markets that integrate sustainable practices and invest in technological development are poised to capitalize on these opportunities.

Key Player Analysis

Key players in the activated carbon market include major corporations such as Cabot Corporation, Kuraray Co., and Calgon Carbon. These firms benefit from strong global presence and comprehensive product lines spanning various applications. Their strategies often involve comprehensive integration from raw material sourcing to product distribution, stabilizing supply chains and ensuring quality production.

Market leaders invest heavily in research and development, enabling innovative product launches tailored to evolving regulatory and consumer demands. Additionally, strategic mergers and acquisitions enable expansion into new markets and diversification of product lines, further strengthening their market position. A diverse service portfolio and consistent focus on technological advancements fuel these companies' competitive edge.

Маrkеt Кеу Рlауеrѕ

• CarbPure Technologies

• Cabot Corporation

• Boyce Carbon

• Jacobi Carbons Group

• CarboTech AC GmbH

• Kuraray Co.

• Haycarb (Pvt) Ltd.

• Kureha Corporation

• Donau Carbon GmbH

• Calgon Carbon Corporation

• Carbon Activated Corporation

• Albemarle Corporation

• Osaka Gas Chemicals Co

• Silcarbon Aktivkohle GmbH

• Evoqua Water Technologies LLC

• Oxbow Activated Carbon LLC

• Other Key Players

Recent Developments

Recent market developments showcase strategic advancements by key companies. In April 2023, Calgon Carbon secured a long-term supply contract with a major water treatment firm, signaling industry stability and growth. Meanwhile, Kuraray introduced a novel activated carbon variant in May 2023, optimizing water treatment efficiency and reducing environmental pollutants. Cabot Corporation also demonstrated expansion efforts with plans to increase production capacity in China by 50% by 2024, addressing rising demand and positioning itself advantageously within the Asian market. These developments underline the strategic investments and innovations necessary to stay competitive amidst escalating demand for cleaner and safer environmental practices.

Conclusion

The activated carbon market stands at the cusp of continued growth, driven by stringent environmental standards and technological innovations. Companies that successfully navigate challenges related to raw material costs and regulatory compliance can leverage considerable market opportunities. By prioritizing sustainable and efficient solutions, investing in technology, and aligning with government incentives, key players can sustain growth and advantage in an increasingly competitive landscape.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Chemical Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release